4QFY2018 Result Update | Plywood

May 19, 2018

Century Plyboards Ltd

Neutral

CMP

`269

Performance Update

Target Price

-

(Rs cr)

4QFY18

4QFY17

% yoy

3QFY17

% qoq

Revenue

544

526

3.5

510

6.7

Stock Info

EBITDA

83

84

(0.7)

88

(5.3)

Sector

Plywood

Market Cap (` cr)

5,976

OPM (%)

15.3%

15.9%

17.2%

Net Debt (` cr)

780

Adjusted PAT

36

56

(36.1)

47

(23.4)

Beta

0.9

Source: Company, Angel Research

52 Week High / Low

364/235

For 4QFY2018, Century Plyboards Ltd. (CPIL) underperformed both on the top

Avg. Daily Volume

36,577

line and bottom line front. Total revenue for the quarter remained flat at `544cr

Face Value (`)

10

BSE Sensex

33,812

compared to `526cr for the year ago period. Operating margin contracted by

Nifty

10,442

60bps on account of increase in raw material cost. On the bottom line front, CPIL

Reuters Code

CNTP.BO

reported a decline of ~36% yoy to `35cr.

Bloomberg Code

CPBI.IN

Top-line remains flattish: Company’s top line reported a lower growth of ~3% to

Shareholding Pattern (%)

`544cr on the back of poor performance in company prime segment i.e. Century

Promoters

72.0

MF / Banks / Indian Fls

4.7

Plywood and Particle board. Century Plywood segment de-grew by ~13.7% yoy

FII / NRIs / OCBs

11.5

during the quarter, whereas Particle Board segment reported a decline of ~7.2%

Indian Public / Others

11.8

yoy. Company’s other products such as Laminate products and Container Frieght

Abs.(%)

3m

1yr

3yr

Station Services also underperformed.

Sensex

7.4

27.1

22.9

Higher input costs impacted overall profitability: On the operating front, the

CPIL

(17.5)

3.5

51.8

company margin contracted by 60bps on account of higher raw material costs.

On the bottom line front, company’s Profit after Tax declined by ~36% to `35cr

mainly due to the increase in depreciation cost and interest rates.

Outlook & Valuation: We expect CPIL to report top-line CAGR of ~11% to

`2,537cr over FY18-20E. On the bottom-line front, we estimate ~18% CAGR to

3-year price chart

`230cr over the same period. Considering the overall poor performance of

400

350

4QFY18 results and depreciation of currency by 10% since Jan 2018 which would

300

further impact the overall profitability (as company imports 50% raw material), we

250

200

maintain Neutral rating on CPIL.

150

100

50

Key Financials

0

Y/E March (`cr)

FY2017

FY2018

FY2019E

FY2020E

Net Sales

1,819

2,060

2,307

2,538

Source: Company, Angel Research

% chg

10.8

13.3

12.0

10.0

Net Profit

193

166

199

230

% chg

14.0

(14.1)

19.6

15.9

OPM (%)

17.2

16.1

17.0

17.3

EPS (`)

8.7

7.5

8.9

10.4

P/E (x)

31.0

36.1

30.2

26.1

Amarjeet S Maurya

P/BV (x)

8.4

7.0

5.9

5.1

022-39357800 Ext: 6831

RoE (%)

27.1

19.3

19.6

19.4

RoCE (%)

18.9

14.7

16.0

16.5

EV/Sales (x)

3.6

3.3

2.9

2.6

Please refer to important disclosures at the end of this report

1

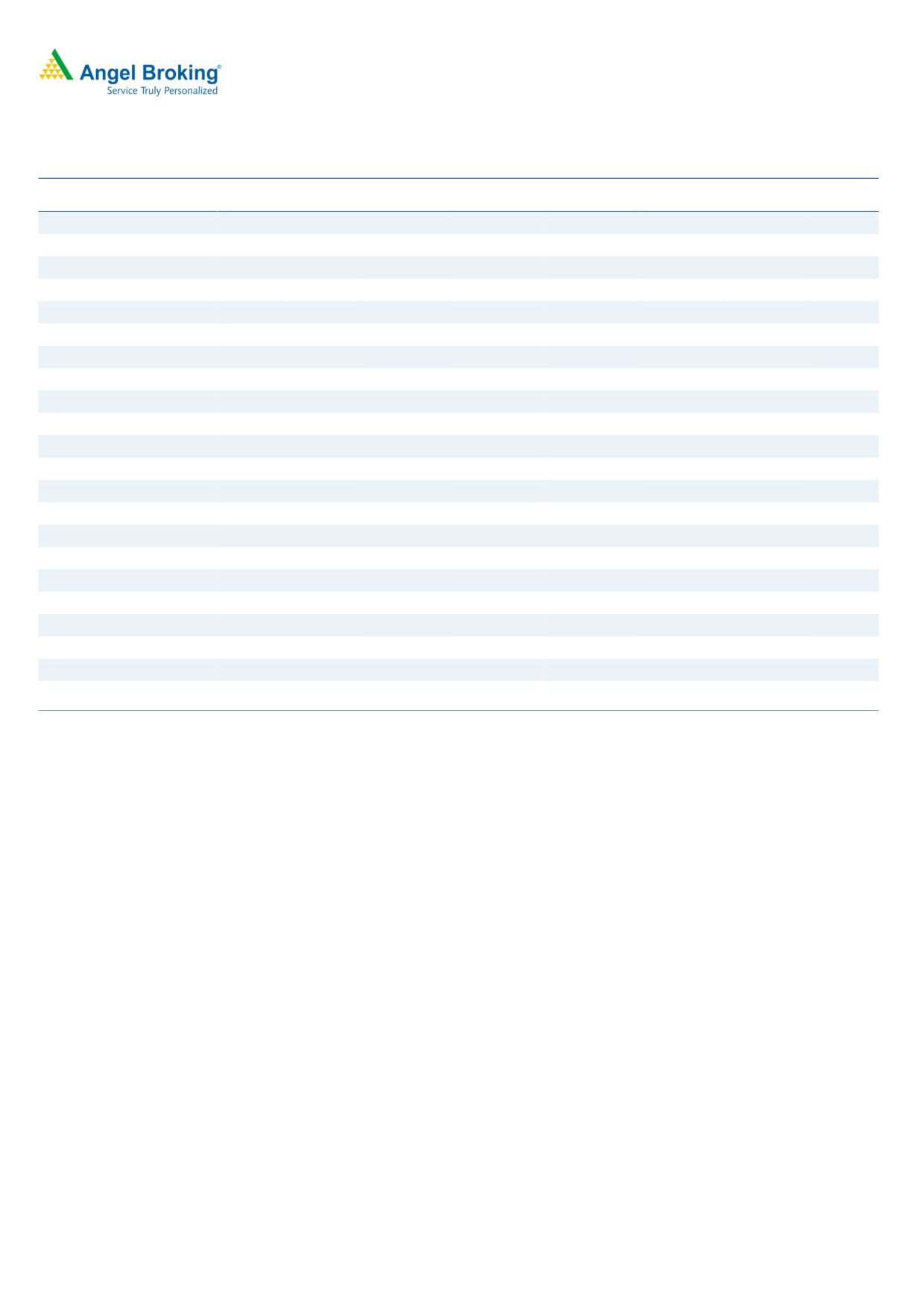

Century Plyboards Ltd | 4QFY2018 Result Update

Exhibit 1: 4QFY2018 Performance

Y/E March (`cr)

4QFY18

4QFY17

% yoy

3QFY18

% qoq

FY2018

FY2017

% chg

Net Sales

544

526

3

510

6.7

2,002

1,920

4.3

Consumption of RM

274

253

8.2

261

5.0

1,023

918

11.4

(% of Sales)

50.3

48.1

51.1

51.1

47.8

Staff Costs

75

67

12.7

72

4.0

284

257

10.6

(% of Sales)

13.8

12.7

14.2

14.2

13.4

Other Expenses

112

122

(8.4)

89

25.5

389.11

454

(14.2)

(% of Sales)

20.6

23.2

17.5

19.4

23.6

Total Expenditure

461

442

4.3

422

9.2

1,696

1,628

4.2

Operating Profit

83

84

(0.7)

88

(5.3)

306

292

4.8

OPM

15.3

15.9

17.2

15.3

15.2

Interest

12.2

2.6

377.3

6.3

94.5

33

29

14.1

Depreciation

27.7

15.6

78.2

26.3

5.4

81

52

54.7

Other Income

1

14

4

7

23

PBT (excl. Ext Items)

45

80

(44.2)

59

(25.1)

199

234

(14.8)

Ext (Income)/Expense

PBT (incl. Ext Items)

45

80

(44.2)

59

(25.1)

199

234

(14.8)

(% of Sales)

8.2

15.2

11.7

9.9

12.2

Provision for Taxation

9

24

13

42

48

(% of PBT)

19.8

30.0

21.5

21.3

20.6

Reported PAT

35.72

55.91

(36.1)

46.66

(23.4)

156.64

185.56

(15.6)

Other Comprehensive Income

0

(0)

-

(0)

-

Total Comprehensive Income

36.09

55.64

(35.1)

46.40

(22.2)

Source: Company, Angel Research

May 19, 2018

2

Century Plyboards Ltd | 4QFY2018 Result Update

Outlook & Valuation: We expect CPIL to report top-line CAGR of ~11% to

`2,537cr over FY18-20E. On the bottom-line front, we estimate ~18% CAGR to

`230cr over the same period. Considering the overall poor performance of

4QFY18 results and depreciation of currency by 10% since Jan 2018 which would

further impact the overall profitability (as company imports 50% raw material), we

maintain Neutral rating on CPIL.

Downside risks to our estimates

Given that the Company has significant forex exposure on account of majority

raw materials being imported from other countries, in addition to ECB loans,

any unfavorable change in currency may pose forex risks, which could

significantly impact margins.

Recently, the company has added a new MDF plant with capex of `380cr; any

slowdown in MDF market can impact the company’s earnings due to higher

fixed cost overheads.

Company Background

Century Plyboards (India) Ltd (CPIL) is a plywood manufacturer. The company's

segments include plywood, laminate, CFS services and others. The company's

geographical segments are India and overseas. The plywood segment includes

plywood, block-board, veneer and timber. The laminate segment includes

decorative laminates and pre-laminated boards. The CFS services segment

includes container freight station services. The others segment includes mainly

trading of chemicals, minerals, readymade furniture and equipments. The

company's product portfolio includes doors, decorative veneer, new age products

(NAP), fiber cement boards, particle boards, look book, slimline, mono core,

magnetic laminates and prelaminated boards. CPIL is also engaged in the logistics

business through the management of a container freight station. The Company's

units are spread across India in Joka (West Bengal), Guwahati (Assam), Kandla

(Gujarat), Chennai (Tamil Nadu) and Karnal (Haryana).

May 19, 2018

3

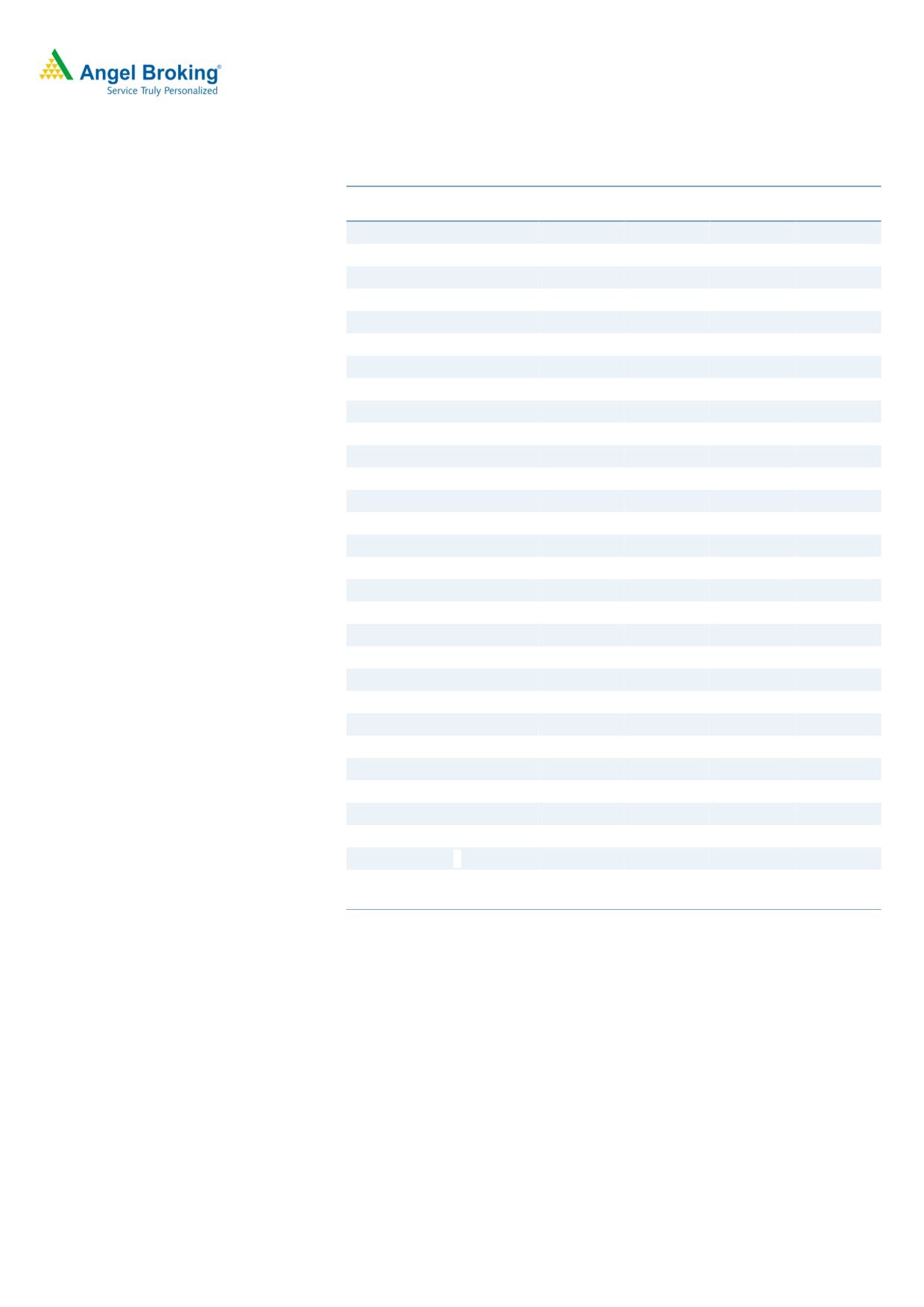

Century Plyboards Ltd | 4QFY2018 Result Update

Consolidated Profit & Loss Statement

Y/E March (`cr)

FY2017

FY2018

FY2019E

FY2020E

Total operating income

1,819

2,060

2,307

2,538

% chg

10.8

13.3

12.0

10.0

Total Expenditure

1,507

1,729

1,915

2,099

Raw Material

895

986

1,107

1,231

Personnel

273

313

358

398

Others Expenses

339

430

450

470

EBITDA

312

331

392

439

% chg

7.8

6.1

18.5

11.9

(% of Net Sales)

17.2

16.1

17.0

17.3

Depreciation& Amortisation

59

91

108

115

EBIT

253

240

285

324

% chg

4.4

(4.8)

18.4

13.8

(% of Net Sales)

13.9

11.7

12.3

12.8

Interest & other Charges

30

36

39

39

Other Income

23

8

9

10

(% of PBT)

9.2

3.7

3.5

3.4

Share in profit of Associates

-

-

-

-

Recurring PBT

245

212

255

295

% chg

22.4

(13.3)

20.0

15.9

Tax

52

46

56

65

(% of PBT)

21.0

21.8

22.0

22.0

PAT (reported)

193

166

199

230

Minority Interest (after tax)

-

-

-

-

Profit/Loss of Associate Company

-

-

-

-

ADJ. PAT

193

166

199

230

% chg

14.0

(14.1)

19.6

15.9

(% of Net Sales)

10.6

8.1

8.6

9.1

Basic EPS (`)

8.7

7.5

8.9

10.4

Fully Diluted EPS (`)

8.7

7.5

8.9

10.4

% chg

14.0

(14.1)

19.6

15.9

May 19, 2018

4

Century Plyboards Ltd | 4QFY2018 Result Update

Consolidated Balance Sheet

Y/E March (`cr)

FY2017

FY2018

FY2019E

FY2020E

SOURCES OF FUNDS

Equity Share Capital

22

22

22

22

Reserves& Surplus

693

837

991

1,166

Shareholders Funds

715

859

1,013

1,188

Minority Interest

12

12

12

12

Total Loans

619

780

770

770

Deferred Tax Liability

1

1

1

1

Total Liabilities

1,347

1,652

1,796

1,971

APPLICATION OF FUNDS

Gross Block

412

924

948

973

Less: Acc. Depreciation

106

197

304

420

Net Block

306

727

643

553

Capital Work-in-Progress

299

299

299

299

Investments

6

6

6

6

Current Assets

905

842

1,094

1,352

Inventories

301

339

398

445

Sundry Debtors

342

389

449

501

Cash

67

21

60

127

Loans & Advances

160

60

150

228

Other Assets

35

33

37

51

Current liabilities

238

291

315

308

Net Current Assets

667

551

779

1,044

Deferred Tax Asset

69

69

69

69

Mis. Exp. not written off

-

-

-

-

Total Assets

1,347

1,652

1,796

1,971

May 19, 2018

5

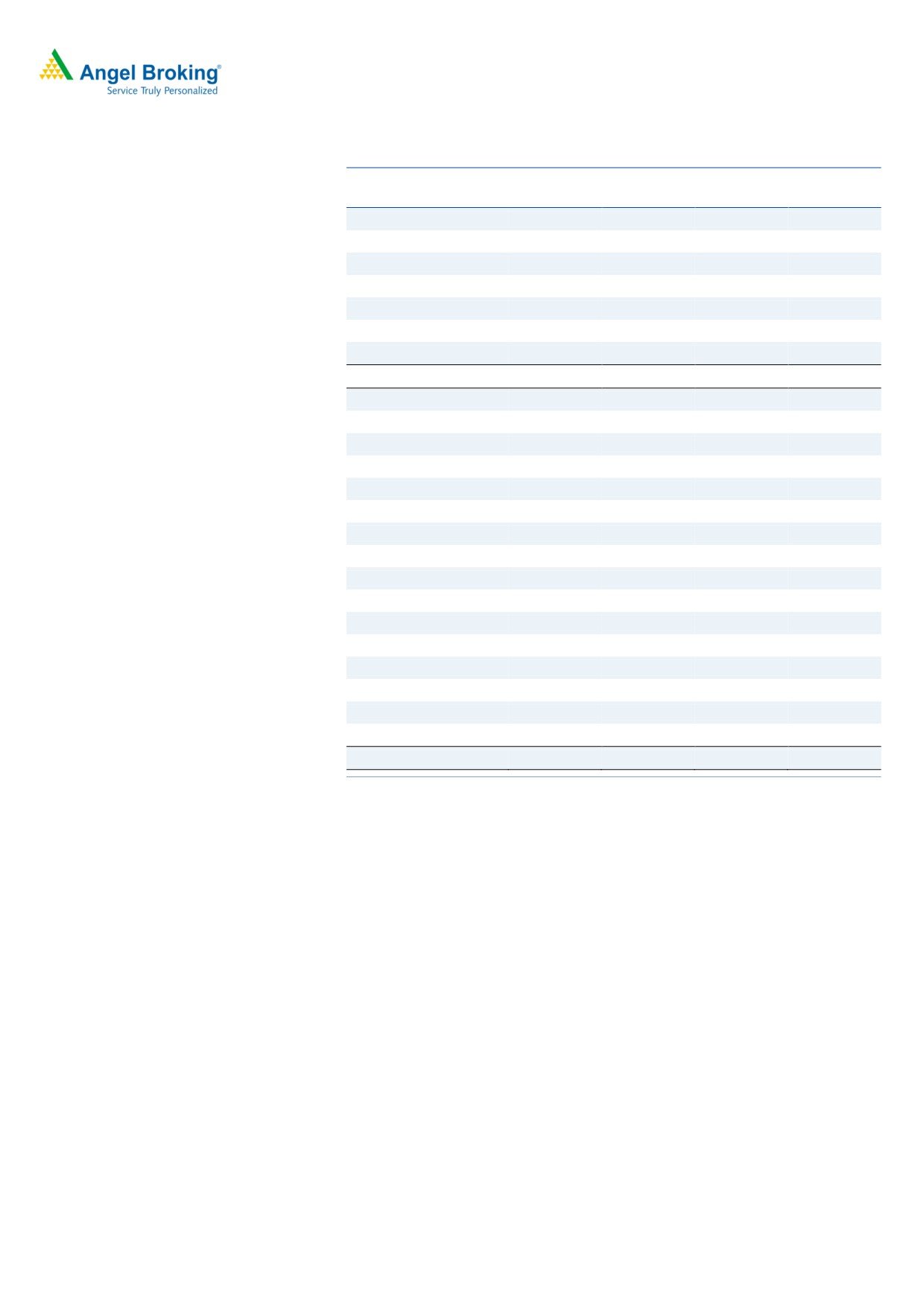

Century Plyboards Ltd | 4QFY2018 Result Update

Consolidated Cash flow Statement

Y/E March (`cr)

FY2017

FY2018

FY2019E FY2020E

Profit before tax

245

212

255

295

Depreciation

59

91

108

115

Change in Working Capital

(54)

70

(189)

(198)

Interest / Dividend (Net)

30

36

39

39

Direct taxes paid

(43)

(46)

(56)

(65)

Others

(17)

0

0

0

Cash Flow from Operations

221

362

156

186

(Inc.)/ Dec. in Fixed Assets

(305)

(512)

(24)

(25)

(Inc.)/ Dec. in Investments

0

0

0

0

Cash Flow from Investing

(304)

(512)

(24)

(25)

Issue of Equity

0

0

0

0

Inc./(Dec.) in loans

142

162

(10)

0

Dividend Paid (Incl. Tax)

(0)

(22)

(45)

(56)

Interest / Dividend (Net)

(30)

(36)

(39)

(39)

Cash Flow from Financing

112

103

(93)

(94)

Inc./(Dec.) in Cash

28

(46)

39

67

Opening Cash balances

39

67

21

60

Closing Cash balances

67

21

60

127

May 19, 2018

6

Century Plyboards Ltd | 4QFY2018 Result Update

Key Ratios

Y/E March

FY2017

FY2018

FY2019E

FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

31.0

36.1

30.2

26.1

P/CEPS

23.7

23.4

19.6

17.4

P/BV

8.4

7.0

5.9

5.1

Dividend yield (%)

0.9

0.4

0.7

0.9

EV/Sales

3.6

3.3

2.9

2.6

EV/EBITDA

21.0

20.4

17.1

15.1

EV / Total Assets

4.9

4.1

3.7

3.4

Per Share Data (`)

EPS (Basic)

8.7

7.5

8.9

10.4

EPS (fully diluted)

8.7

7.5

8.9

10.4

Cash EPS

11.4

11.5

13.8

15.5

DPS

2.5

1.0

2.0

2.5

Book Value

32.1

38.6

45.5

53.4

Returns (%)

ROCE

18.9

14.7

16.0

16.5

Angel ROIC (Pre-tax)

20.0

14.9

16.6

17.7

ROE

27.1

19.3

19.6

19.4

Turnover ratios (x)

Asset Turnover (Gross Block)

4.4

2.2

2.4

2.6

Inventory / Sales (days)

60

60

63

64

Receivables (days)

69

69

71

72

Payables (days)

28

31

31

28

Working capital cycle (ex-cash) (days)

101

98

103

108

Source: Company, Angel Research

May 19, 2018

7

Century Plyboards Ltd | 4QFY2018 Result Update

Research Team Tel: 022 - 39357800

Website:

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of

this document should make such investigations as they deem necessary to arrive at an independent evaluation of an

investment in the securities of the companies referred to in this document (including the merits and risks involved), and

should consult their own advisors to determine the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to

time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The

views contained in this document are those of the analyst, and the company may or may not subscribe to all the views

expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a

report on a company's fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on

as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group

companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent

error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the

information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty,

express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited

endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance,

investment banking or other advisory services in a merger or specific transaction to the companies referred to in this

report, as on the date of this report or in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that

may arise from or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also,

please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt.

Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement Century Plyboard

1. Analyst ownership of the stock No

2. Angel and its Group companies ownership of the stock No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

May 19, 2018

8